The fire insurance market in California is reaching a breaking point as major insurers continue to pull back from high-risk areas. Many large carriers have either stopped writing new policies or dropped existing customers, citing unsustainable wildfire losses and skyrocketing rebuild costs. As a result, an increasing number of homeowners are turning to the California FAIR Plan—the state’s insurer of last resort. However, the FAIR Plan was never designed to handle such widespread demand, and its coverage limitations leave many policyholders exposed.

The FAIR Plan’s Challenges and Its $1 Billion Assessment

With thousands of homeowners forced into the FAIR Plan, the strain on the program has grown significantly. The FAIR Plan provides basic fire insurance but lacks critical protections such as liability and theft, requiring homeowners to purchase supplemental policies for full coverage. Now, as devastating wildfires continue to wreak havoc across the state, questions are mounting about how the FAIR Plan will manage the influx of claims.

Recently, California regulators approved a $1 billion assessment on insurance companies that are part of the FAIR Plan’s membership. This assessment will help cover the mounting claims from recent fires and ensure the program remains solvent. However, with the increasing frequency and intensity of wildfires, many worry whether this financial strategy will be sustainable in the long run. Additionally, as traditional insurers withdraw from the market, the FAIR Plan’s risk pool continues to grow, potentially leading to higher premiums and further financial instability.

The FAIR Plan’s Exposure from LA

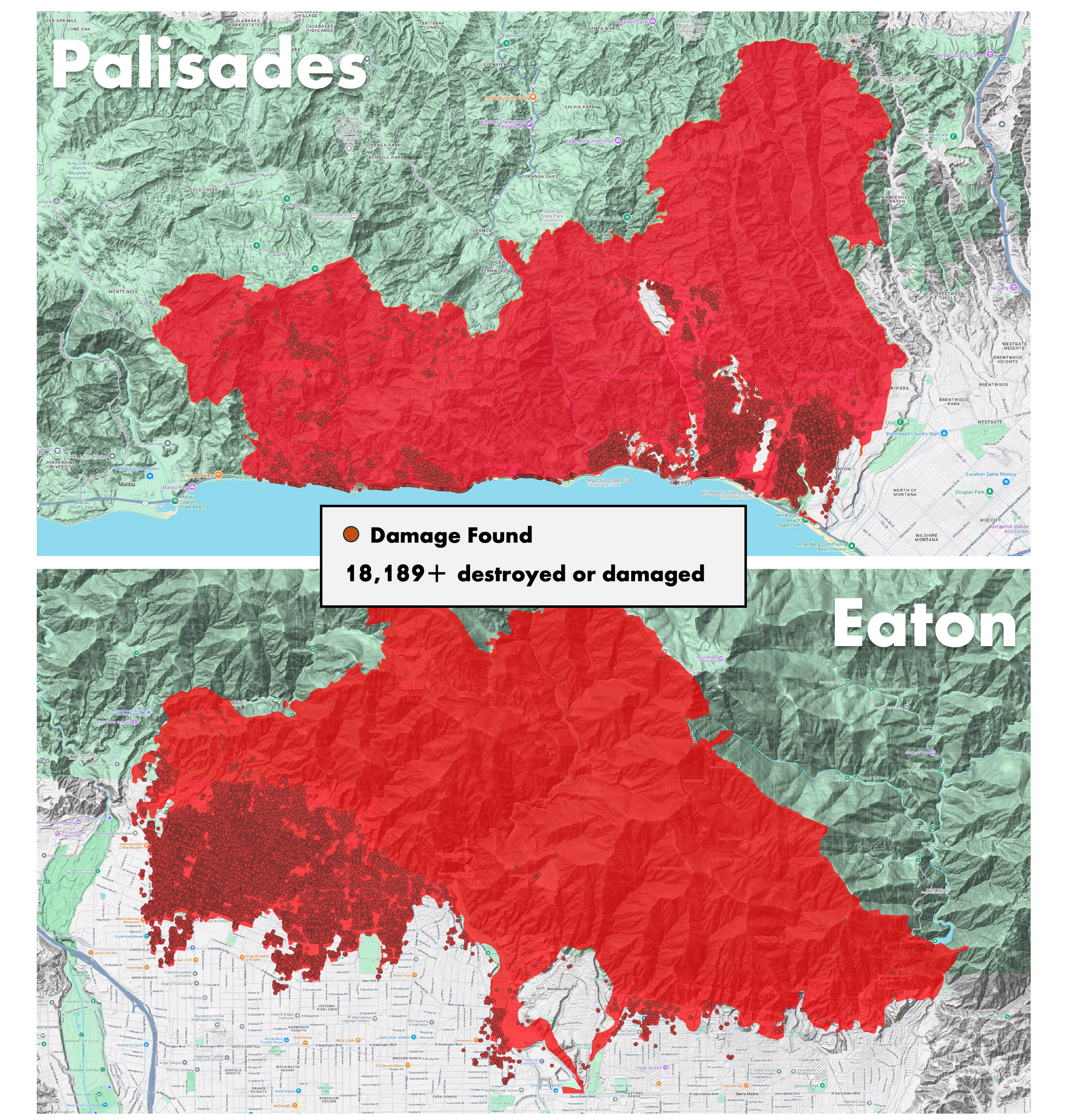

The recent Southern California wildfires have further strained the FAIR Plan’s resources. As of February 19, the FAIR Plan received approximately 3,621 claims related to the Palisades Fire and about 1,369 claims from the Eaton Fire. Initial estimates suggest a potential exposure of over $4 billion for the Palisades Fire and $775 million for the Eaton Fire. To manage these claims, the FAIR Plan has payment mechanisms in place, including reinsurance, to ensure all covered claims are paid.

The California FAIR Plan – an independent, not-for-profit catastrophe insurer of last resort – continues to receive, manage and pay claims related to the Southern California wildfires. To date the FAIR Plan has received approximately 3,621 claims related to the Palisades Fire and about 1,369 claims from the Eaton Fire

A Volatile Future for Homeowners and Insurers

California’s fire insurance crisis is fueled by record-breaking wildfire losses and soaring home rebuild costs. Insurers claim that covering high-risk areas is no longer viable, yet homeowners are left with few options. Unless significant regulatory and industry changes occur, the state’s insurance market may continue its downward spiral, leaving many homeowners vulnerable to both financial and physical risks. RedZone has attempted to play their part by incorporating credit systems into our products to help insurers make more informed underwriting decisions.