Below are exerts from the National Significant Wildland Fire Potential Outlook, provided by the National Interagency Fire Center, for the period of August through November. The full outlook can be located here which will give more insight from a region by region perspective.

Statistics Year-To-Date:

Year-to-date statistics Number of Fires Acreage Burned 2019 (1/1/19 – 7/31/19) 26,465 3,179,054 2009-2018 – Year-to-Date 38,260 3,887,220 Percentage of 10-year Average 69.17% 81.78%

Source: https://www.nifc.gov/fireInfo/nfn.htm

As you can see from the table above this season has been below average in both number of fires and total acreage. Of the nearly 3.2 million acres burned, Alaska’s fire season has accounted for over half accumulating around 1.7 million acres from dozens of big fires north of the border. The past few monthly outlooks have suggested a later start to the fire season due to the El Nino – causing wet winter, so now that we’ve reached August let’s see what’s NIFC says is in store for the next three months of 2019 Fire Season.

Observations in July:

Fire activity continued to be below average (as predicted in the previous Outlook) across most regions except Alaska. Most areas continued to benefit from late spring moisture and overall weather patterns that produced average temperatures during first half of the month. Conditions began to change late in the month with the arrival of the Four Corners high pressure area, which became anchored over the West. As fuels dried, fire activity began to increase. Alaska experienced well above average activity as a long-duration lightning events and all time record heat ignited fuels that had become highly receptive to fire.

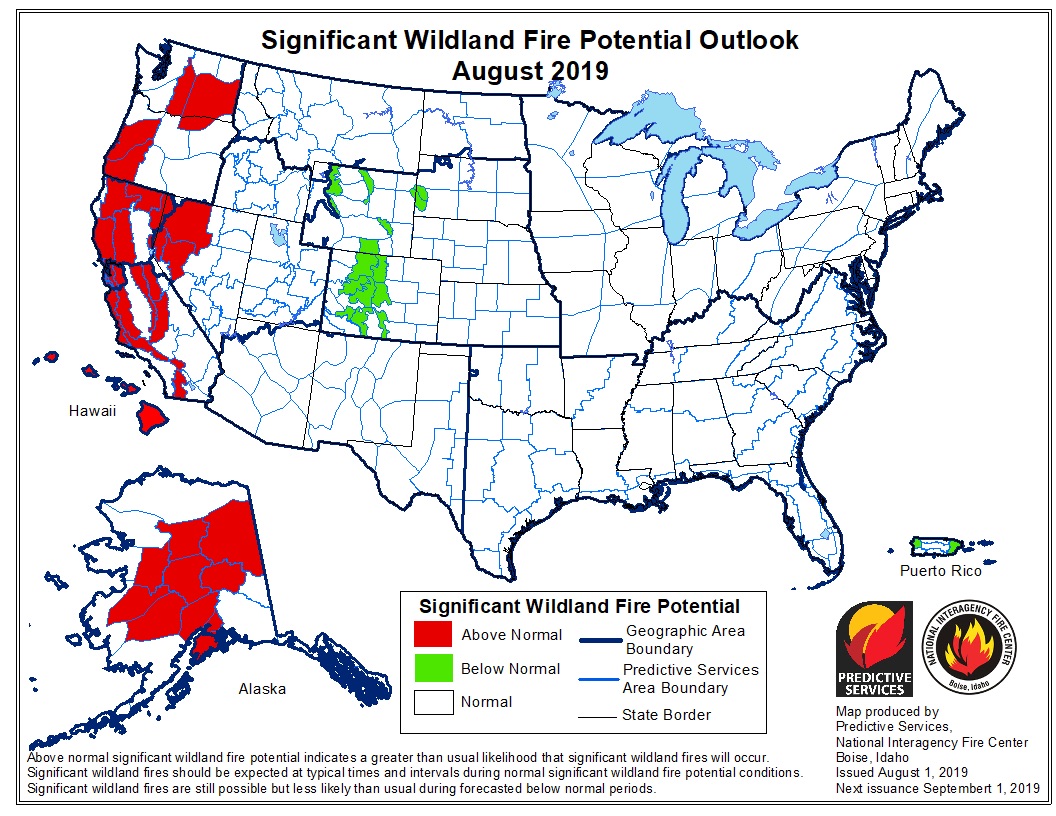

Wildland Fire Outlook for August:

August and early September are the peak periods for fire activity across the western states. The areas of most concern continue to be the lower and middle elevations across California, the northern and western Great Basin, and portions of the Pacific Northwest where the robust grass crop has cured and is now receptive. Timbered locations should become receptive by mid-month. Moderate to severe drought conditions exist across portions of northern Oregon, Washington, northern Idaho and western Montana. However, a recent extended period of cool and periodically moist conditions has lessened the drought stress in the vegetation.

Looking forward, an active but compressed season is expected across the West as the southwestern monsoon becomes more active in August. While this will effectively end the season across the Southwest, lightning-induced fire activity should increase elsewhere. Wind events, which have been largely absent thus far, will increase in frequency by mid-late month as dry frontal passages become a more common occurrence. The occurrence of both wind events and low humidities should translate into an increase in fire behavior and growth. Activity in Alaska will continue to diminish as the frequency of frontal passages increases and as temperatures begin to cool.

Latest Significant Wildland Fire Potential Outlook for August, 2019

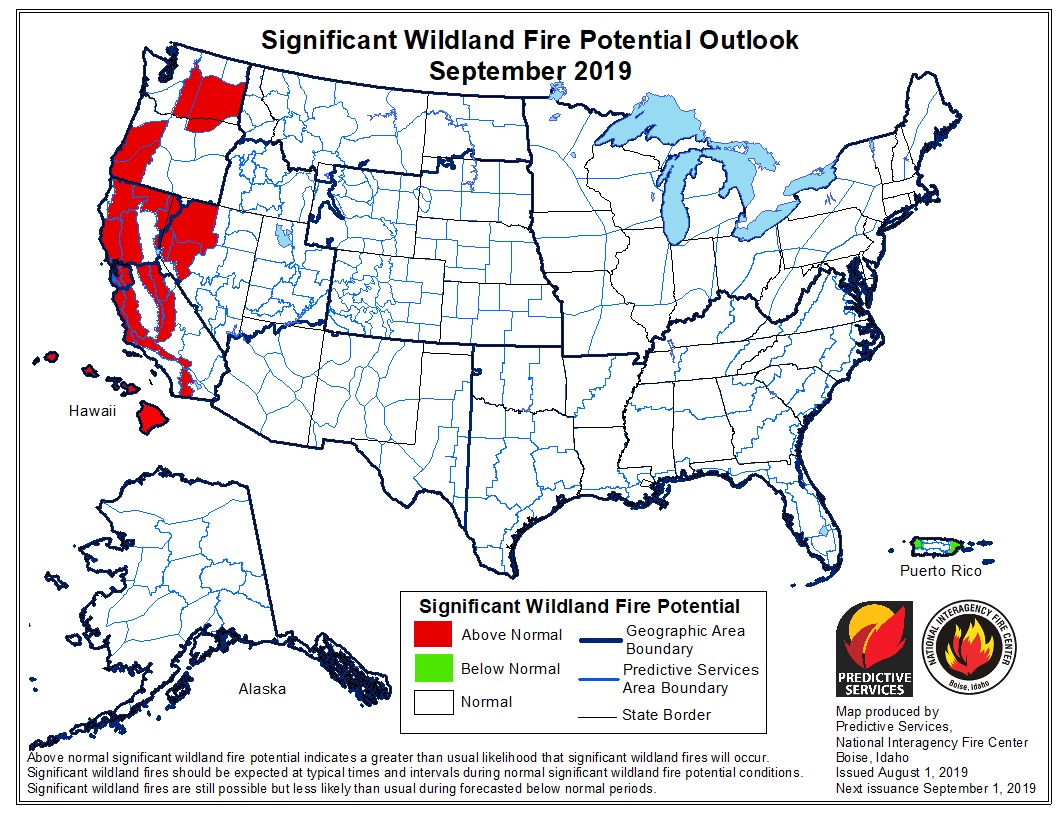

Wildland Fire Outlook for September:

By mid-September the seasonal transition out of the core fire season will be underway as the seasonal transition begins to bring wetting systems to most regions. Above Normal significant large fire potential is expected coastal Oregon and Washington, eastern Washington, Northern CA into Nevada and California’s Central Coast mountains. Both Hawaii and Alaska are expected to be above normal in September as well.

Latest Potential Wildfire Outlook for the Month of September, 2019

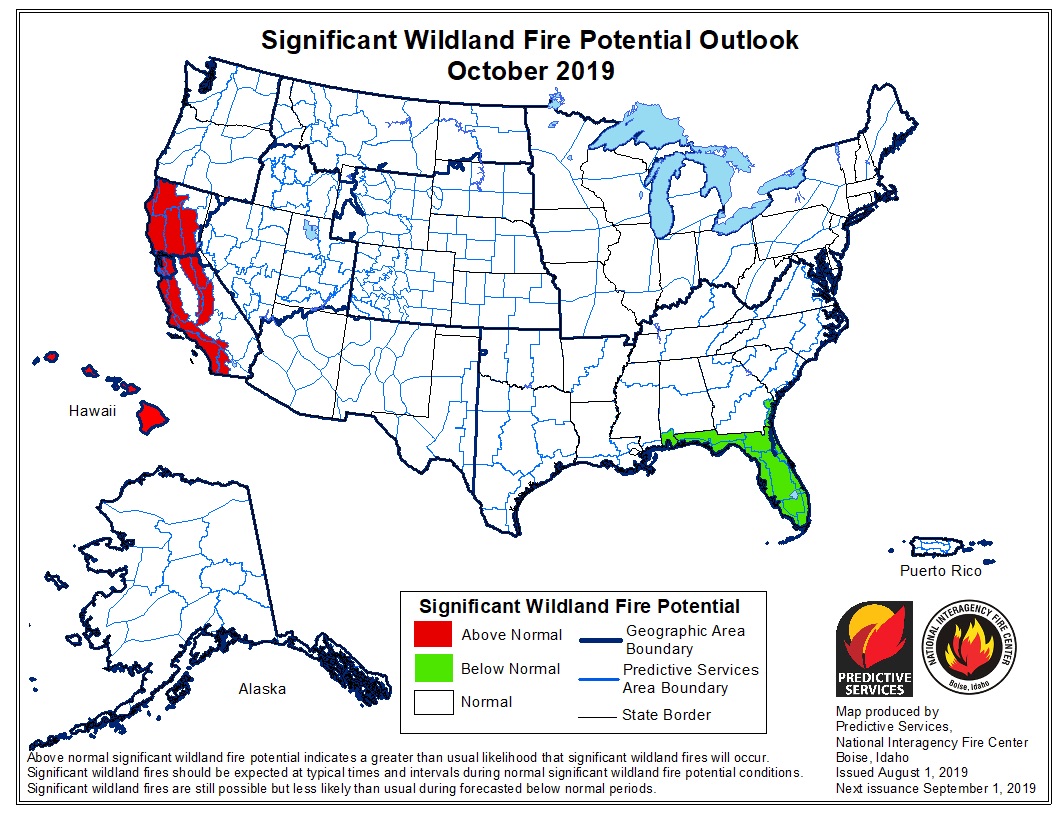

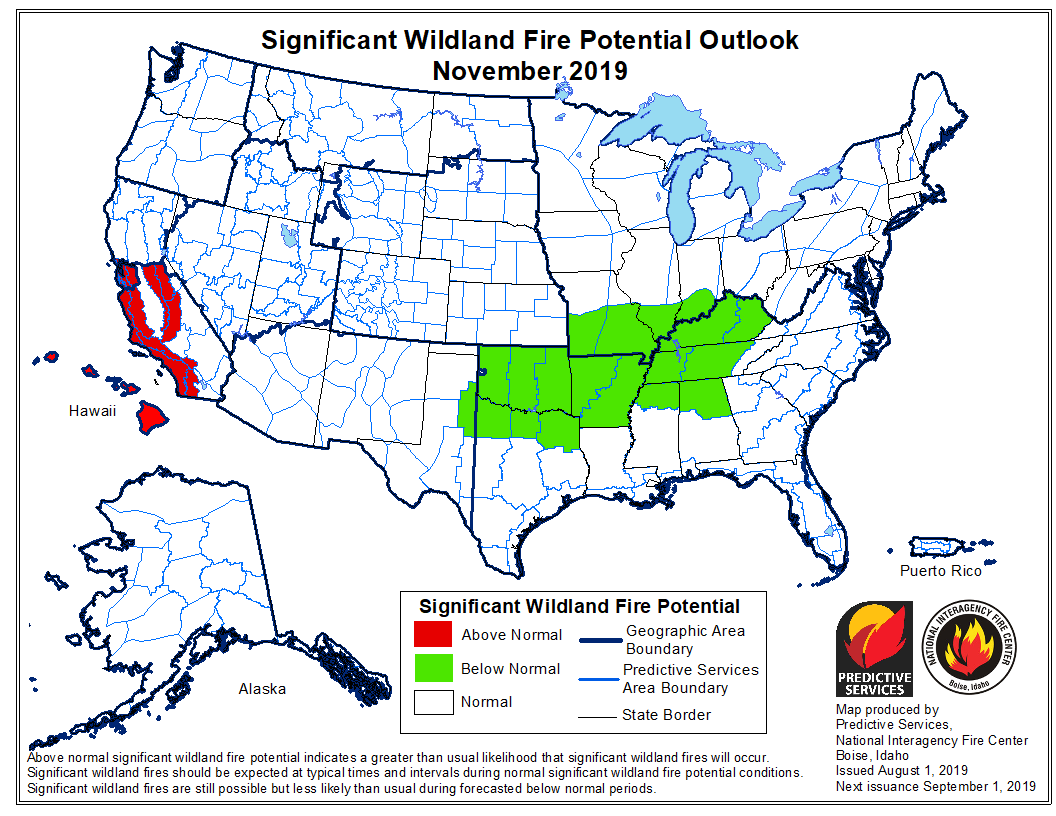

Wildland Fire Outlook for October and November:

By October and November, however, California will reenter the fire season as Foehn Wind events begin to develop. Concerns this year are higher than average due to the presence of an abundant crop of fine fuels in the lower to middle elevations.

Latest Wildfire Potential Outlook for October, 2019

Latest Wildfire Potential Outlook for November, 2019

Source: NIFC Predictive Services