Back in April we outlined how Flooding is the by far the most common natural disaster and therefore the worst in terms of costliness, death, and destruction. Flooding woes come in many ways too, including long-term swelling lakes and rivers, storm surge and coastal flooding from Hurricanes and Tropical storms, and flash floods from downpours from severe thunderstorms. Last year’s Hurricane Harvey alone caused over 125 billion dollars, mostly from the widespread flooding across East Texas and Louisiana.

More Flooding Woes from Hurricane Florence

Yet another example of the ongoing cost of flooding was this month’s Hurricane Florence over the Carolinas. Five major watersheds saw an average of 17.5 inches of rain over four days, calculated to be the second worst in the last 70 years (second only to Hurricane Harvey’s 25.6 inches). The storm caused widespread flooding across a 14,000 sq mile area across both states. With two of the worst storms in consecutive years, leading meteorologists are blaming warmer oceans, more moisture and slower moving storms due in various ways to climate change causing tropical cyclones to dump more rain.

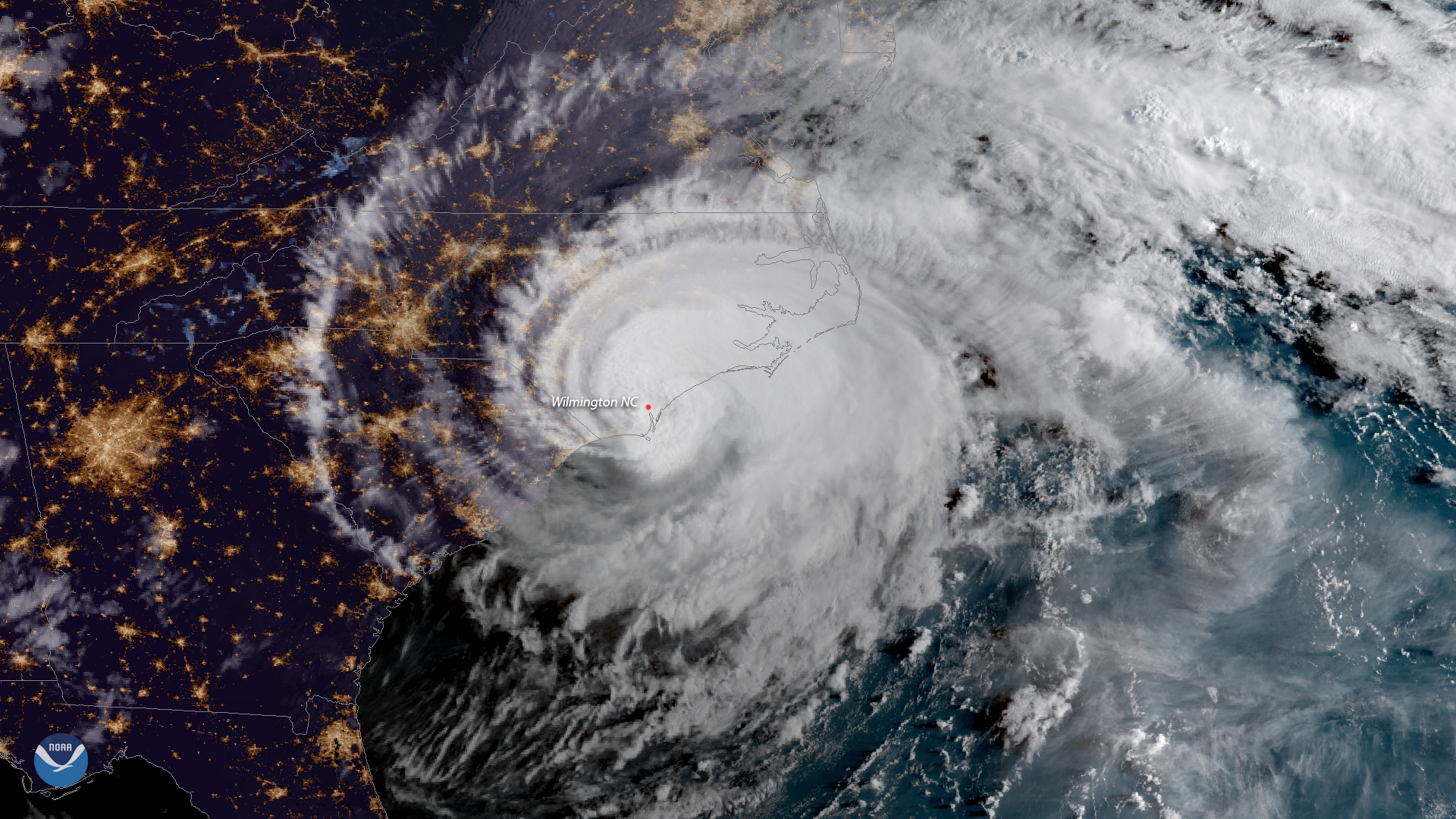

NOAA’s view of Hurricane Florence making Landfall near Wilmington, NC on September 14th

12 counties in North Carolina, where the storm made landfall near Wilmington, remain under varying types of evacuation orders as flood waters are either still cresting or very slowly receding. Consequently, nearly 300 roads are still closed across NC and neighborhoods in cities that thought they made it through the event unscathed are now being impacted. The toll on residents and infrastructure is estimated in the ballpark of 38 billion (and rising), making it the sixth costliest tropical cyclone on record.

Insurance Should Help, No?

Just as after last year’s Harvey impact (125 billion), flood insurance again has been a hot topic. With estimates of a million people dealign with flooding woes across the two states, it’s no surprise that in the aftermath of Florence there’s been a heap of national news coverage on the issue. If you google “Florence Flood Insurance” every article highlights the dire situation and elaborates on the fact that typical homeowner’s insurance doesn’t cover most of the people (estimated at 85%) affected. The other 15% have opted in to their insurance plan’s specialized flood coverage or were informed enough to join the National Flood Insurance Program (NFIP). Whether the others are uninformed, can’t pay, or don’t want to pay extra they are now (similar to Houston residents after Harvey) in what these articles are calling a ‘miserable’ fallout situation.

Members of the 106th Rescue Squadron, 106th Rescue Wing, New York Air National Guard, drop from an HC-130J Combat King II aircraft during a rescue mission during Hurricane Florence, Sept. 17, 2018.(U.S. Air Force photo by Senior Airman Kyle Hagan)

Florence, like Harvey, turned out to be less of a wind event and with flood excluded on most homeowner’s policies, experts from the insurer point of view are expecting to deal with a “manageable” and “insignificant” event. Of the $38 billion dollar bill, only an estimated $1.7 billion to $4.6 billion will fall on the insurance industry from Florence’s winds and storm surge (damage from which are covered).

Question: Who will pay for homeowners who want to rebuild their homes then?

Answer 1: The Homeowner

- Uninsured homeowners will have to pay out of pocket or get loans from the Federal Government to pay for repairs to their flood-damaged homes. The loans have to be repaid in full.

Answer 2: The Taxpayers (indirectly)

- The NFIP is vastly under-funded by policyholder revenue and multiple loans and bailouts since Hurricane Katrina have the taxpayers regularly on the hook for billions of dollars in relief.

This New York Times article sums this up nicely.

Flooding affects the US populace, both coastal and inland, every year. Implications from flooding events are statistically worsening whether from continued warming oceans and climate change or something else causing these outlier events to be more regular. Flooding woes like this month’s Florence is life changing for a huge number of people and communities, and unfortunately, it seems it’s but a matter of time until the next one with the same storyline.

Sources

CBS News

NY Times

Insurance Journal

Think Realty

National Flood Insurance Program (NFIP)

FEMA